Your What does redlining mean in real estate images are available in this site. What does redlining mean in real estate are a topic that is being searched for and liked by netizens now. You can Find and Download the What does redlining mean in real estate files here. Download all free vectors.

If you’re looking for what does redlining mean in real estate images information related to the what does redlining mean in real estate interest, you have visit the right site. Our website always provides you with hints for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

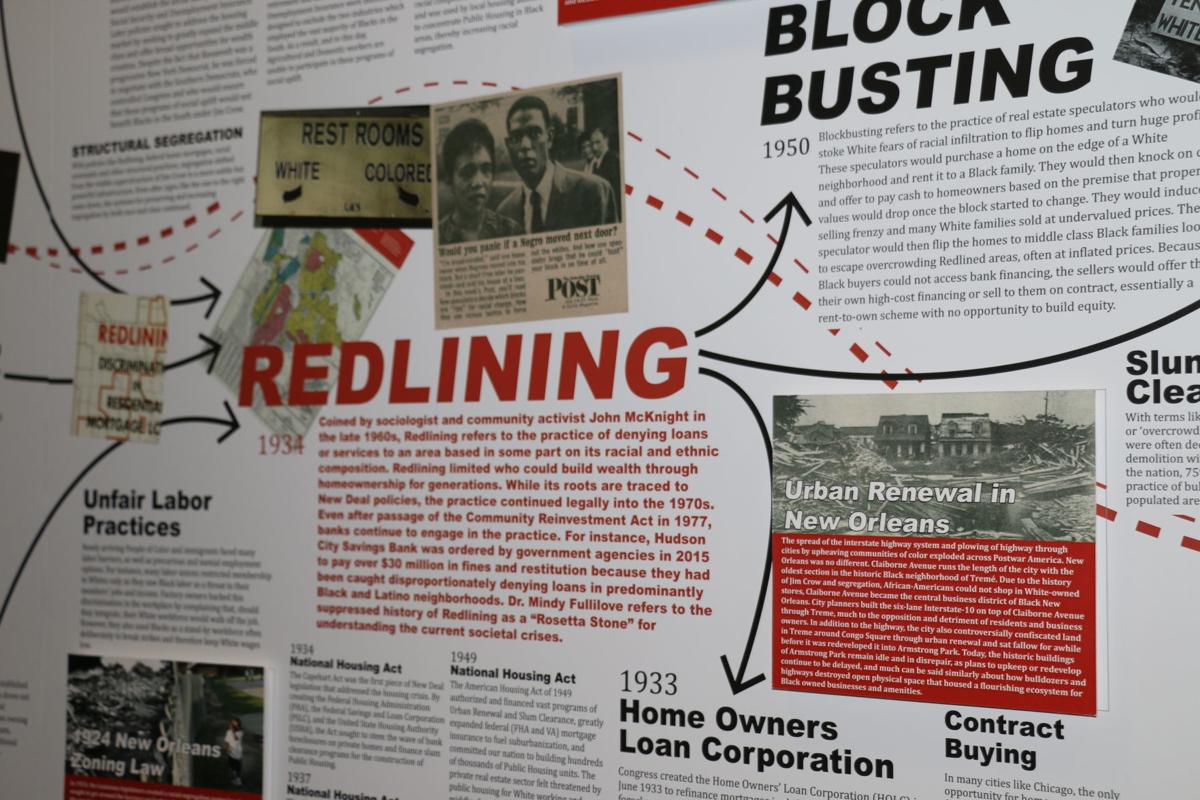

What Does Redlining Mean In Real Estate. The labeling of urban areas home to communities of colour as hazardous known as redlining has had lasting impacts in the US. The term redlining is a nod to how lenders identified and referenced neighborhoods with a greater share of people deemed more likely to default on mortgage. In this video Ive explained about discriminatory practices of Redlining and Reverse Redlining in Mortgage Real Estate i. Redlining is a discriminatory practice that puts services financial and otherwise out of reach for residents of certain areas based on race or ethnicity.

Redlining And Neighborhood Health Ncrc From ncrc.org

Redlining And Neighborhood Health Ncrc From ncrc.org

Redlining is a term used to refer to a now-illegal practice in the mortgage lending industry. Although redlining was technically outlawed under the Fair Housing Act of 1968 its impact is longstanding and has even birthed another form of housing discrimination. Real estate buyers sellers renters and professionals must be cognizant of certain unethical and illegal practices involving real estate transactions. As a result financial institutions would refuse to lend to people who wanted to purchase homes in these areas. The Forum has created a visualization of redlining in several cities. Redlining a process by which banks and other institutions refuse to offer mortgages or offer worse rates to customers in certain neighborhoods based on their racial and ethnic composition is one of the clearest examples of institutionalized racism in the history of the United States.

As a result financial institutions would refuse to lend to people who wanted to purchase homes in these areas.

Using red ink lenders outlined on paper. Updated July 05 2020 Redlining describes a practice by some mortgage lenders when they refuse to lend money or extend credit to borrowers in certain areas of town or for other discriminatory reasons. Redlining a process by which banks and other institutions refuse to offer mortgages or offer worse rates to customers in certain neighborhoods based on their racial and ethnic composition is one of the clearest examples of institutionalized racism in the history of the United States. Using red ink lenders outlined on paper. The term redlining is a nod to how lenders identified and referenced neighborhoods with a greater share of people deemed more likely to default on mortgage. Redlining real estate involves the systematic denial of loans to certain communities those supposedly outlined in red on private maps because the banks consider them financially risky.

Even if a credit-worthy applicant applied to buy a home in those neighborhoods they could be denied. Redlining discrimination primarily focuses on minority communities and has been illegal for over 50 years. Using red ink lenders outlined on paper. In this lesson youll learn about redlining. What Is Redlining.

Source: nationalgeographic.com

Source: nationalgeographic.com

It can also apply when real estate agents follow similar practices in. Although redlining was technically outlawed under the Fair Housing Act of 1968 its impact is longstanding and has even birthed another form of housing discrimination. Redlining real estate involves the systematic denial of loans to certain communities those supposedly outlined in red on private maps because the banks consider them financially risky. The term redlining is a nod to how lenders identified and referenced neighborhoods with a greater share of people deemed more likely to default on mortgage. In this video Ive explained about discriminatory practices of Redlining and Reverse Redlining in Mortgage Real Estate i.

Source: shelterforce.org

Source: shelterforce.org

The labeling of urban areas home to communities of colour as hazardous known as redlining has had lasting impacts in the US. Redlining discrimination primarily focuses on minority communities and has been illegal for over 50 years. The practice is now illegal but has contributed to persistent racial segregation and disparities. Real estate buyers sellers renters and professionals must be cognizant of certain unethical and illegal practices involving real estate transactions. According to John McKnight the sociologist who coined the term in the 1960s redlining is the discriminatory practice of outlining areas where banks.

Source: offcite.org

Source: offcite.org

Using red ink lenders outlined on paper. In the real estate and finance industry redlining refers to the practice of financial institutions defining specific neighborhoods or areas on a map as less desirable to lend to. It can also apply when real estate agents follow similar practices in. Redlining real estate involves the systematic denial of loans to certain communities those supposedly outlined in red on private maps because the banks consider them financially risky. Redlining is a discriminatory practice that puts services financial and otherwise out of reach for residents of certain areas based on race or ethnicity.

Source: ally.com

Source: ally.com

According to John McKnight the sociologist who coined the term in the 1960s redlining is the discriminatory practice of outlining areas where banks. Updated July 05 2020 Redlining describes a practice by some mortgage lenders when they refuse to lend money or extend credit to borrowers in certain areas of town or for other discriminatory reasons. Redlining real estate involves the systematic denial of loans to certain communities those supposedly outlined in red on private maps because the banks consider them financially risky. What is Redlining in Real Estate. In this lesson youll learn about redlining.

Source: realtor.com

Source: realtor.com

The term redlining is a nod to how lenders identified and referenced neighborhoods with a greater share of people deemed more likely to default on mortgage. In this video Ive explained about discriminatory practices of Redlining and Reverse Redlining in Mortgage Real Estate i. Redlining is a discriminatory practice that puts services financial and otherwise out of reach for residents of certain areas based on race or ethnicity. The labeling of urban areas home to communities of colour as hazardous known as redlining has had lasting impacts in the US. It can also apply when real estate agents follow similar practices in.

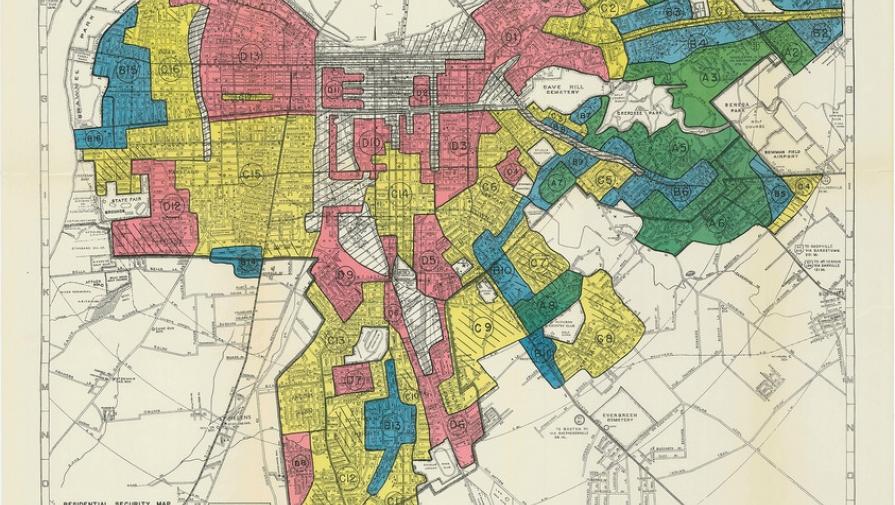

Source: lojic.org

Source: lojic.org

Although the practice was formally outlawed in 1968 with the passage of the Fair Housing Act. Redlining is a practice that banks and the federal government previously used to deny mortgage loans and other services to people primarily people of color living in what they considered to be undesirable neighborhoods. The practice is now illegal but has contributed to persistent racial segregation and disparities. Even if a credit-worthy applicant applied to buy a home in those neighborhoods they could be denied. Lenders used to draw red lines around portions of a map to indicate areas of a city in which they didnt want to make loans.

Source: nola.com

Source: nola.com

Although redlining was technically outlawed under the Fair Housing Act of 1968 its impact is longstanding and has even birthed another form of housing discrimination. Although redlining was technically outlawed under the Fair Housing Act of 1968 its impact is longstanding and has even birthed another form of housing discrimination. Redlining real estate involves the systematic denial of loans to certain communities those supposedly outlined in red on private maps because the banks consider them financially risky. Redlining a process by which banks and other institutions refuse to offer mortgages or offer worse rates to customers in certain neighborhoods based on their racial and ethnic composition is one of the clearest examples of institutionalized racism in the history of the United States. In the real estate and finance industry redlining refers to the practice of financial institutions defining specific neighborhoods or areas on a map as less desirable to lend to.

Source: ncrc.org

Source: ncrc.org

Redlining is a practice that banks and the federal government previously used to deny mortgage loans and other services to people primarily people of color living in what they considered to be undesirable neighborhoods. Redlining a process by which banks and other institutions refuse to offer mortgages or offer worse rates to customers in certain neighborhoods based on their racial and ethnic composition is one of the clearest examples of institutionalized racism in the history of the United States. Updated July 05 2020 Redlining describes a practice by some mortgage lenders when they refuse to lend money or extend credit to borrowers in certain areas of town or for other discriminatory reasons. Redlining is a type of lending discrimination. Real estate buyers sellers renters and professionals must be cognizant of certain unethical and illegal practices involving real estate transactions.

Source: study.com

Source: study.com

Redlining discrimination primarily focuses on minority communities and has been illegal for over 50 years. The Forum has created a visualization of redlining in several cities. Updated July 05 2020 Redlining describes a practice by some mortgage lenders when they refuse to lend money or extend credit to borrowers in certain areas of town or for other discriminatory reasons. Redlining real estate involves the systematic denial of loans to certain communities those supposedly outlined in red on private maps because the banks consider them financially risky. Although redlining was technically outlawed under the Fair Housing Act of 1968 its impact is longstanding and has even birthed another form of housing discrimination.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

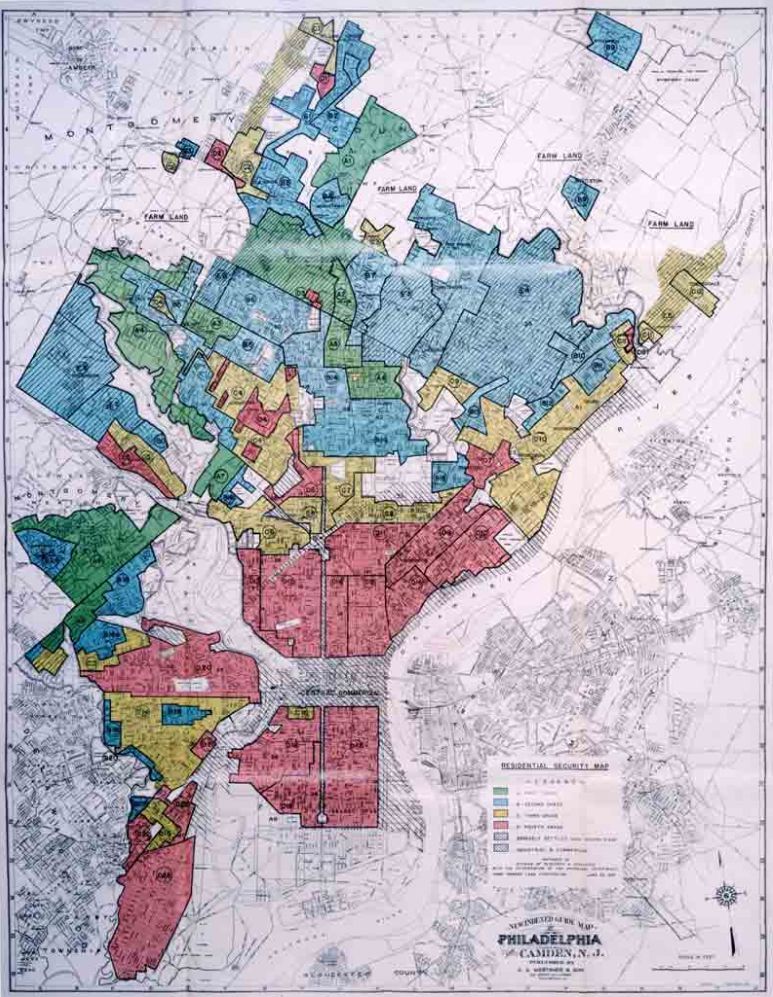

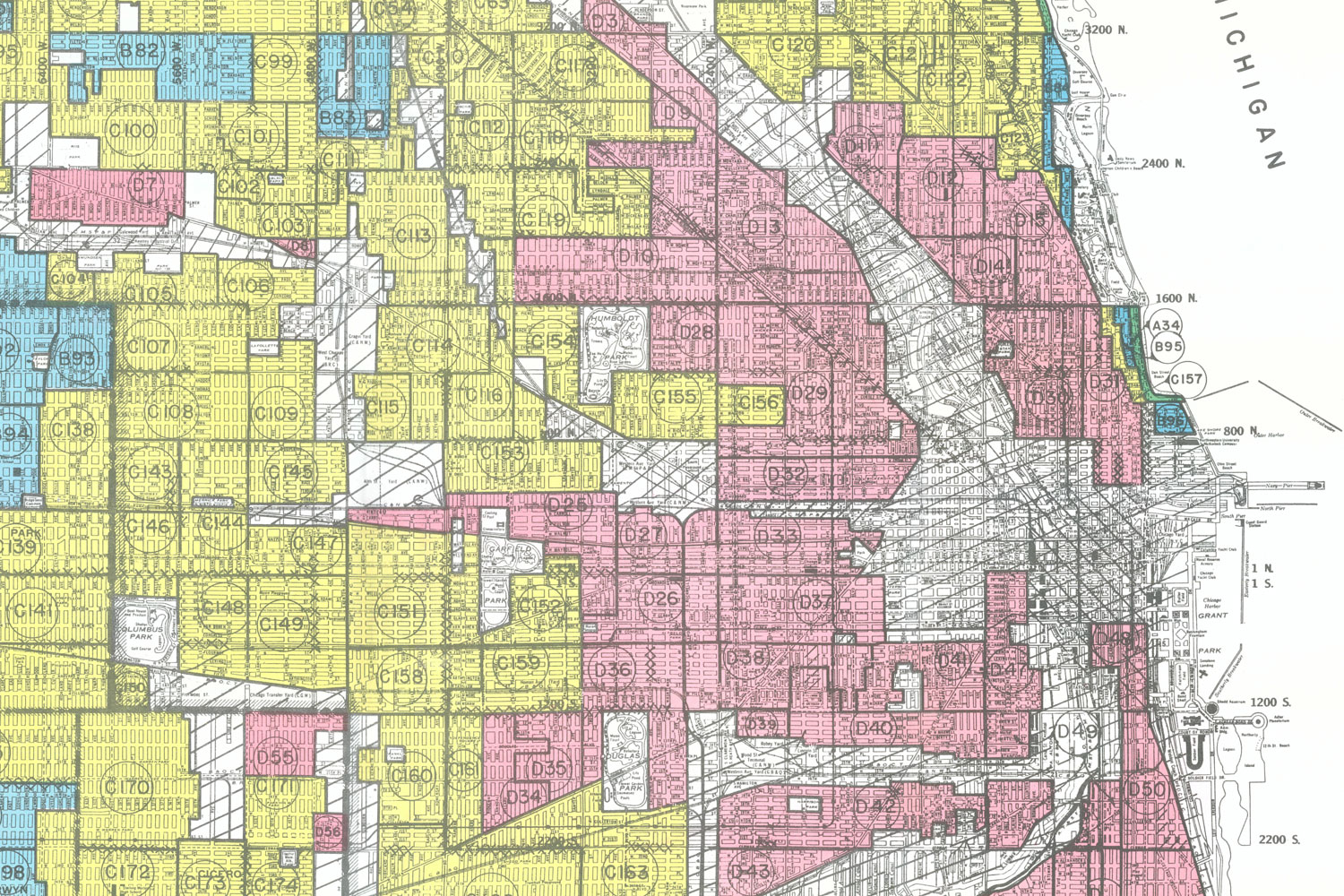

The Forum has created a visualization of redlining in several cities. The labeling of urban areas home to communities of colour as hazardous known as redlining has had lasting impacts in the US. Redlining is a practice that banks and the federal government previously used to deny mortgage loans and other services to people primarily people of color living in what they considered to be undesirable neighborhoods. Redlining a process by which banks and other institutions refuse to offer mortgages or offer worse rates to customers in certain neighborhoods based on their racial and ethnic composition is one of the clearest examples of institutionalized racism in the history of the United States. Updated July 05 2020 Redlining describes a practice by some mortgage lenders when they refuse to lend money or extend credit to borrowers in certain areas of town or for other discriminatory reasons.

Source: ncrc.org

Source: ncrc.org

What is Redlining in Real Estate. Even if a credit-worthy applicant applied to buy a home in those neighborhoods they could be denied. Redlining is a practice that banks and the federal government previously used to deny mortgage loans and other services to people primarily people of color living in what they considered to be undesirable neighborhoods. Redlining is a discriminatory practice that puts services financial and otherwise out of reach for residents of certain areas based on race or ethnicity. What Is Redlining.

Source: michiganradio.org

Source: michiganradio.org

Redlining is a discriminatory practice based on demographics. Redlining is a type of lending discrimination. Redlining is a discriminatory practice based on demographics. As a result financial institutions would refuse to lend to people who wanted to purchase homes in these areas. What is Redlining in Real Estate.

Source: ncrc.org

Source: ncrc.org

Redlining is a discriminatory practice that puts services financial and otherwise out of reach for residents of certain areas based on race or ethnicity. Redlining is a term used to refer to a now-illegal practice in the mortgage lending industry. Redlining a process by which banks and other institutions refuse to offer mortgages or offer worse rates to customers in certain neighborhoods based on their racial and ethnic composition is one of the clearest examples of institutionalized racism in the history of the United States. In the real estate and finance industry redlining refers to the practice of financial institutions defining specific neighborhoods or areas on a map as less desirable to lend to. It can also apply when real estate agents follow similar practices in.

Source: chicagomag.com

Source: chicagomag.com

Lenders used to draw red lines around portions of a map to indicate areas of a city in which they didnt want to make loans. According to John McKnight the sociologist who coined the term in the 1960s redlining is the discriminatory practice of outlining areas where banks. Even if a credit-worthy applicant applied to buy a home in those neighborhoods they could be denied. Redlining is a discriminatory practice that puts services financial and otherwise out of reach for residents of certain areas based on race or ethnicity. In the real estate and finance industry redlining refers to the practice of financial institutions defining specific neighborhoods or areas on a map as less desirable to lend to.

Source: nationalgeographic.com

Source: nationalgeographic.com

Redlining is a discriminatory practice based on demographics. The labeling of urban areas home to communities of colour as hazardous known as redlining has had lasting impacts in the US. Although redlining was technically outlawed under the Fair Housing Act of 1968 its impact is longstanding and has even birthed another form of housing discrimination. Lenders used to draw red lines around portions of a map to indicate areas of a city in which they didnt want to make loans. Real estate buyers sellers renters and professionals must be cognizant of certain unethical and illegal practices involving real estate transactions.

Source: ncrc.org

Source: ncrc.org

Although redlining was technically outlawed under the Fair Housing Act of 1968 its impact is longstanding and has even birthed another form of housing discrimination. The labeling of urban areas home to communities of colour as hazardous known as redlining has had lasting impacts in the US. The Forum has created a visualization of redlining in several cities. Using red ink lenders outlined on paper. The practice is now illegal but has contributed to persistent racial segregation and disparities.

Using red ink lenders outlined on paper. Lenders used to draw red lines around portions of a map to indicate areas of a city in which they didnt want to make loans. In the real estate and finance industry redlining refers to the practice of financial institutions defining specific neighborhoods or areas on a map as less desirable to lend to. Real estate buyers sellers renters and professionals must be cognizant of certain unethical and illegal practices involving real estate transactions. Although the practice was formally outlawed in 1968 with the passage of the Fair Housing Act.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what does redlining mean in real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.